1099 Form is a tax form used in the United States to report various types of income other than wages, salaries, and tips. It is typically used to report income earned as an independent contractor, freelancer, or self-employed individual. There are different types of 1099 Forms, such as 1099-MISC, 1099-INT, 1099-DIV, and more, depending on the nature of the income being reported. The form is used by both the payer (the entity or person making the payment) and the recipient (the person receiving the payment) to report income to the Internal Revenue Service (IRS). The filing deadline for the 1099 Forms is typically January 31st of the year following the tax year in which the payments were made.

Here are some common types of 1099 Forms:

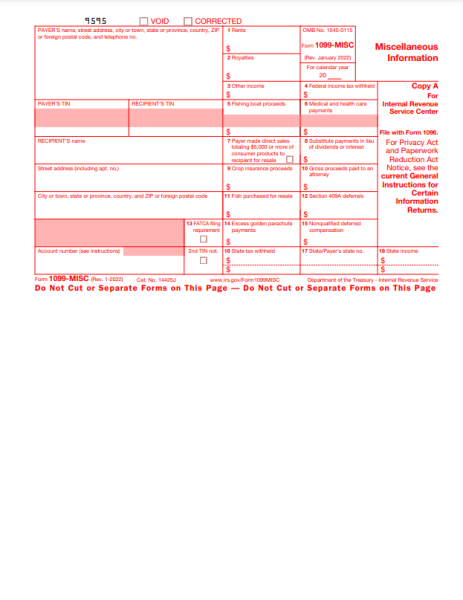

- 1099-MISC: This form is used to report miscellaneous income, such as payments made to independent contractors, freelancers, or self-employed individuals.

- 1099-INT: This form is used to report interest income earned from various sources, such as bank accounts, loans, or investment accounts.

- 1099-DIV: This form is used to report dividends and distributions received from investments, such as stocks or mutual funds.

- 1099-B: This form is used to report proceeds from the sale of stocks, bonds, or other securities.

- 1099-R: This form is used to report distributions from retirement accounts, such as pensions, annuities, or IRAs.

- 1099-G: This form is used to report government payments, such as unemployment compensation, tax refunds, or state and local tax credits.

- 1099-K: This form is used to report payment card and third-party network transactions, such as those made through platforms like PayPal or Stripe.

Our team is here to assist you with 1099 Form filing. We have the expertise and knowledge to help you navigate through the process. Some of the challenges associated with the 1099 Form are:

- Understanding the different types of 1099 Forms: There are several variations of the 1099 Form. Each form is used to report different types of income, and it can be confusing to determine which form to use for a specific situation.

- Gathering accurate information: As a payer, you need to collect accurate information from the payee, including their name, address, and taxpayer identification number (TIN). This can be challenging if the payee fails to provide the necessary information or if there are errors in the provided information.

- Meeting deadlines: The IRS has strict deadlines for filing 1099 Forms. Failure to file on time can result in penalties. Keeping track of these deadlines and ensuring timely filing can be a challenge, especially if you have multiple 1099 Forms to file.

- Compliance with regulations: The IRS has specific rules and regulations regarding the reporting of income on 1099 Forms. It is essential to understand and comply with these regulations to avoid penalties or audits.

- Handling corrections and amendments: If you make an error on a filed 1099 Form, then you may need to issue a corrected form. This can be a complex process, especially if the error involves multiple forms or if the correction needs to be made after the filing deadline.

- Maintaining records: It is crucial to keep copies of all filed 1099 Forms and related documentation for at least three years. Managing and organizing these records can be challenging, especially if you have a high volume of forms to handle.