Employment Taxes

Form 941 Rates

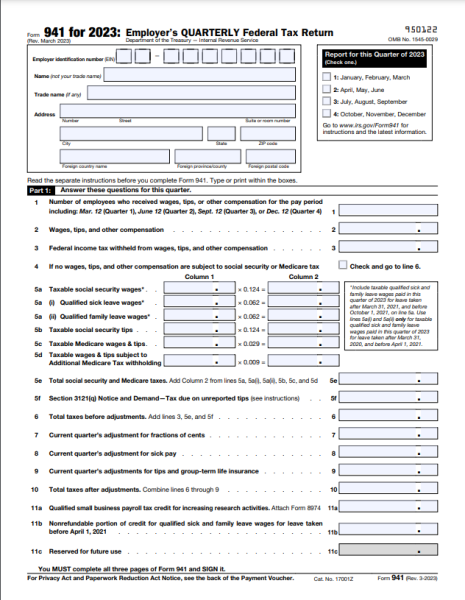

The rates for Form 941 vary depending on the type of employment tax being reported. Here are the current rates in 2023:

Social Security Tax: The Social Security tax rate is 6.2% of wages paid by both the employer and the employee. However, there is a wage base limit, which means that only wages up to a certain amount are subject to this tax. For 2023, the wage base limit is $147,000.

Medicare Tax: The Medicare tax rate is 1.45% of all wages paid by both the employer and the employee. Unlike the Social Security tax, there is no wage base limit for Medicare tax. Additionally, there is an Additional Medicare Tax of 0.9% that applies to wages above a certain threshold. For 2023, the threshold is $200,000 for individuals and $250,000 for married couples filing jointly.

Federal Income Tax Withholding: The federal income tax withholding rate depends on the employee's taxable wages and the information provided on their Form W-4. The IRS withholding tables or the percentage method is utilized to calculate the amount of federal income tax to withhold from each paycheck.