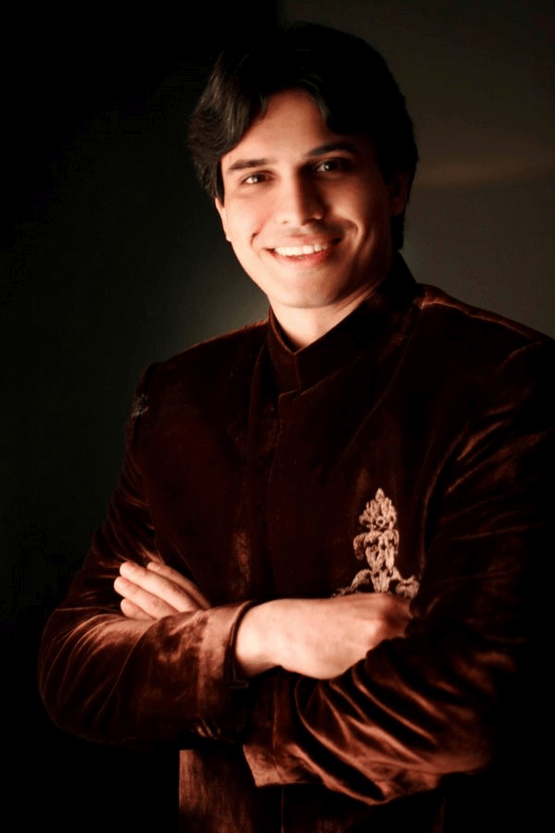

About The CEO – The Professional Certified Public Accountant

Arjumand J. Khan (Shan/A.J.) is the CEO and a licensed Certified Public Accountant with years of experience in Budget Analysis, Financial Audits, Internal Audit, SOX Compliance, Financial Management, Corporate Tax, Individual Income Tax, Tax Dispute, Credit Repair, Accounting, and other services.

He is an accomplished tax professional with over 20 years of knowledge managing tax planning, preparation, and filing. He is an expert in federal, state, and local tax principles and for applying optimal procedures for filing and paying these authorities. He is also experienced in handling IRS communications and audits, and is known for having exceptional aptitude to solve tax-related problems efficiently and creatively.