info@cpaclinics.com

info@cpaclinics.com

Tax Info

PREPARING FOR TAX DAY

USE THESE TIPS TO BE READY FOR TAX FILING!

• Copies of Drivers License or State IDs

• Social Security Cards

• Proof of Residence for dependents claiming EIC

Other Tax Documents:

- • IRA contributions

- • Energy credits

- • Student loan interest

- • Medical Savings Account (MSA) contributions

- • Moving expenses (for tax years prior to 2018 only)

- • Self-employed health insurance payments

- • Keogh, SEP, SIMPLE and other self-employed pension plans

- • Alimony paid that is tax deductible

- • Educator expenses

- • State and local income taxes paid

- • Real estate taxes paid

- • Personal property taxes — vehicle license fee based on value

- • Estimated tax payment made during the year, prior year refund applied to current year, and any amount paid with an extension to file.

- • Direct deposit information — routing and account numbers

- • Foreign bank account information — location, name of bank, account number, peak value of account during the year

TAX INFO

PREPARE FOR TAX DAY

Income documents:

- • Income from jobs: forms W-2 for you and your spouse

- • Investment income — various forms 1099 (-INT, -DIV, -B, etc.), K-1s, stock option information

- • Income from state and local income tax refunds and/or unemployment: forms 1099-G

- • Taxable alimony received

- • Business or farming income — profit/loss statement, capital equipment information

- • If you use your home for business — home size, office size, home expenses, office expenses

- • IRA/pension distributions — forms 1099-R, 8606

- • Rental property income/expense — profit/Loss statement, rental property suspended loss information

- • Social Security benefits — forms SSA-1099

- • Income from sale of property — original cost and cost of improvements, escrow closing statement, cancelled debt information (form 1099-C)

- • Prior year installment sale information — forms 6252, principal and Interest collected during the year, SSN and address of payer

- • Other miscellaneous income — jury duty, gambling winnings, Medical Savings Account (MSA), scholarships, etc.

Tax Deduction Documents:

- • Advance Child Tax Credit payment

- • Child care costs — provider’s name, address, tax id, and amount paid

- • Education costs — forms 1098-T, education expenses

- • Adoption costs — SSN of child, legal, medical, and transportation costs

- • Home mortgage interest and points you paid — Forms 1098

- • Investment interest expense

- • Charitable donations — cash amounts and value of donated property, miles driven, and out-of-pocket expenses

- • Casualty and theft losses — amount of damage, insurance reimbursements

- • Other miscellaneous tax deductions — union dues, unreimbursed employee expenses (uniforms, supplies, seminars, continuing education, publications, travel, etc.) (for tax years prior to 2018 only)

- • Medical and dental expenses

CURRENT TAX RATES AND BRACKETS

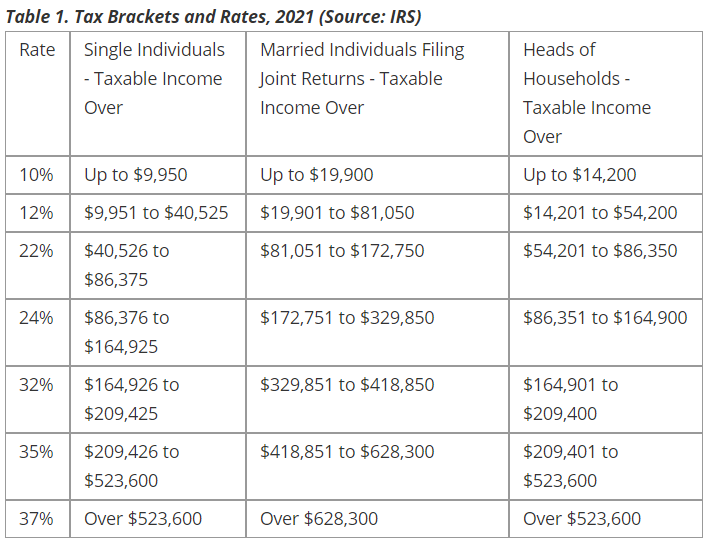

CONTACT US2021 Tax Brackets Income Tax Brackets and Rates

For 2021, income limits for all tax brackets as well as all filers will be adjusted for inflation and will be as follows. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $523,600 and higher for single filers and $628,300 and higher for married couples filing jointly. (SEE Table 1)

As you review the brackets, the income ranges for each rate have been adjusted for inflation.

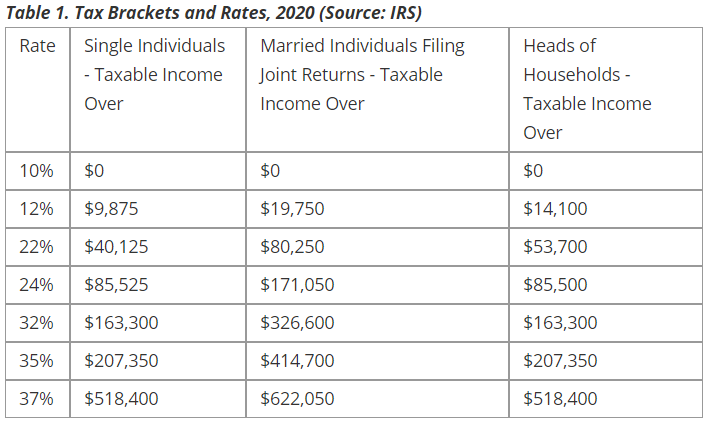

2020 Tax Brackets Income Tax Brackets and Rates

For 2020, income limits for all tax brackets as well as all filers will be adjusted for inflation and will be as follows. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $518,400 and higher for single filers and $622,050 and higher for married couples filing jointly. (SEE Table 1)

As you review the brackets, the income ranges for each rate have been adjusted for inflation.

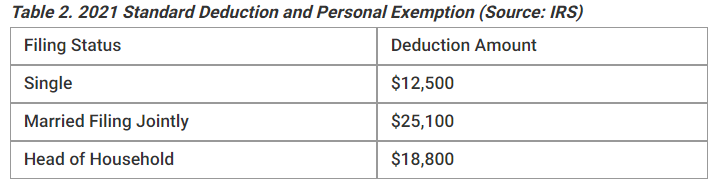

Standard Deduction and Personal Exemption

Standard deductions for single filers has increased by $150; $300 for married couples filing jointly (SEE Table 2). The personal exemption for 2021 remains eliminated.

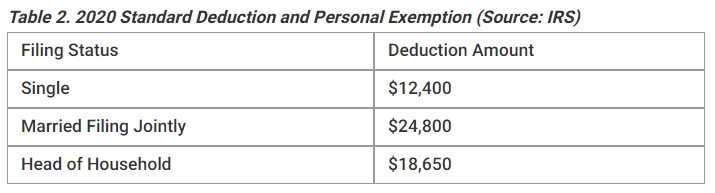

Standard Deduction and Personal Exemption

Standard deductions for single filers has increased by $200; $400 for married couples filing jointly (SEE Table 2). The personal exemption for 2020 remains eliminated.

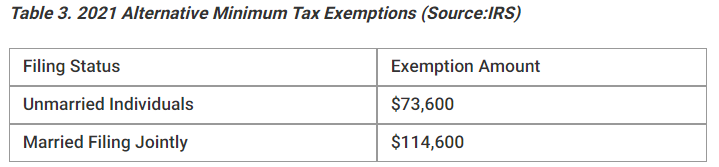

Alternative Minimum Tax

Created in the 1960s, The Alternative Minimum Tax (AMT) was setup to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT. The taxpayer then needs to pay the higher of the two. More information can be found at IRS.Gov (SEE Table 3).

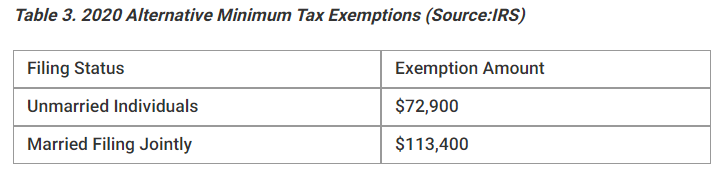

Alternative Minimum Tax

The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT. The taxpayer then needs to pay the higher of the two. More information can be found at IRS.Gov (SEE Table 3).

In 2021, the 28 percent AMT rate applies to excess AMTI of $199,900 for all taxpayers ($99,950 for married couples filing separate returns).

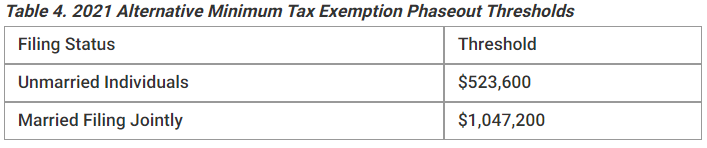

AMT exemptions phase out at 25 cents per dollar earned once taxpayer AMTI hits a certain threshold. In 2021, the exemption will start phasing out at $523,600 in AMTI for single filers and $1,047,200 for married taxpayers filing jointly (SEE Table 4).

In 2020, the 28 percent AMT rate applies to excess AMTI of $197,900 for all taxpayers ($98,950 for married couples filing separate returns).

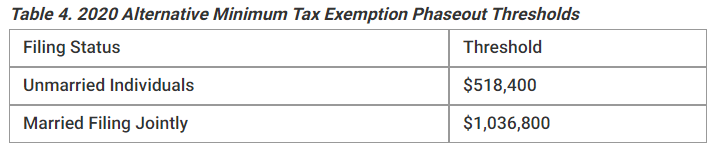

AMT exemptions phase out at 25 cents per dollar earned once taxpayer AMTI hits a certain threshold. In 2020, the exemption will start phasing out at $518,400 in AMTI for single filers and $1,036,800 for married taxpayers filing jointly (SEE Table 4).

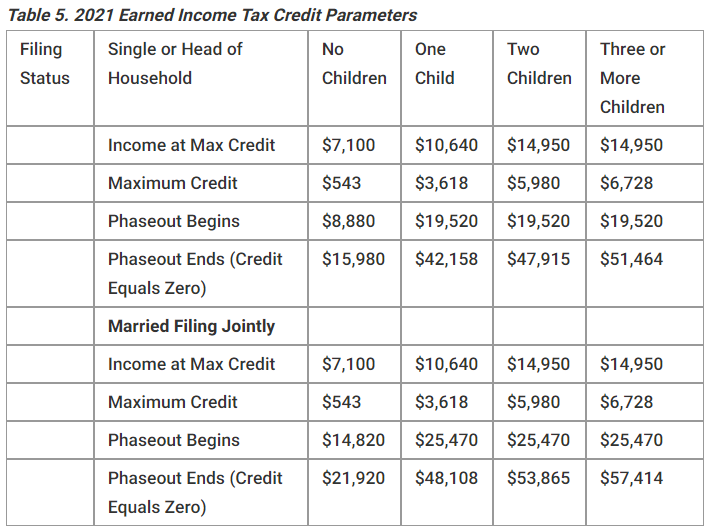

Earned Income Tax Credit

Maximum Earned Income Tax Credit in 2021 for single and joint filers is $543, if the filer has no children (SEE Table 5). The maximum credit is $3,618 for one child, $5,980 for two children, and $6,728 for three or more children. These are small increases compared to 2020.

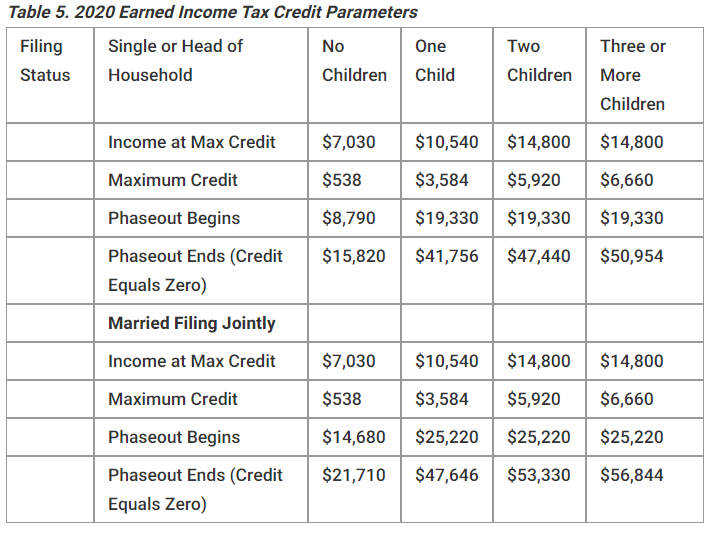

Earned Income Tax Credit

Maximum Earned Income Tax Credit in 2020 for single and joint filers is $538, if the filer has no children (SEE Table 5). The maximum credit is $3,584 for one child, $5,828 for two children, and $6,660 for three or more children. These are small increases compared to 2019.

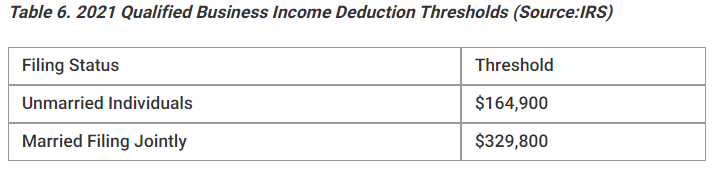

Qualified Business Income Deduction

The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses against up to $164,900 of qualified business income for single taxpayers and $329,800 for married taxpayers filing jointly (SEE Table 6).

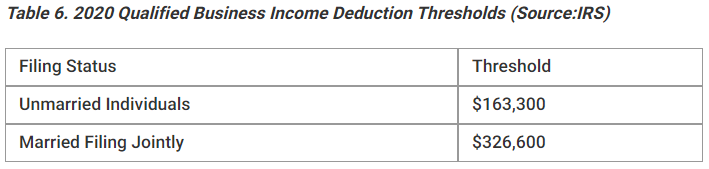

Qualified Business Income Deduction

The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses against up to $163,300 of qualified business income for single taxpayers and $326,600 for married taxpayers filing jointly (SEE Table 6).

IMPORTANT TAX DATES FOR 2021

FILING DATES

- Jan. 11, 2021: Deadline for employees who earned more than $20 in tip income in December 2020 to report this income to their employers on Form 4070

- Jan. 15, 2021: Deadline to pay the fourth-quarter estimated tax payment for tax year 2020

- Feb. 1, 2021: Deadline for employers to mail out W-2 Forms to their employees and for businesses to furnish 1099 Forms reporting non-employee compensation, bank interest, dividends, and distributions from a retirement plan

- Feb. 1, 2021: Deadline for financial institutions to mail out Form 1099-B relating to sales of stock, bonds, or mutual funds through a brokerage account, Form 1099-S relating to real estate transactions; and Form 1099-MISC, if the sender is reporting payments in boxes 8 or 14

- Feb. 1, 2021: Deadline for catching up on unpaid fourth-quarter estimated taxes without additional penalties by filing 2020 tax returns

- Feb. 10, 2021: Deadline for employees who earned more than $20 in tip income in January 2021 to report this income to their employers

- March 1, 2021: Deadline for businesses to mail Forms 1099 and 1096 to the IRS

- March 2, 2021: Deadline for farmers and fishermen to file individual income tax returns

- March 10, 2021: Deadline for employees who earned more than $20 in tip income in February 2021 to report this income to their employers

- March 15, 2021: Deadline for corporate tax returns (Form 1120-S) for tax year 2020, or to request an automatic six-month extension of time to file (Form 7004) for corporations that use the calendar year as their tax year, and for filing partnership tax returns (Form 1065) or to request an automatic five-month extension of time to file (Form 7004)

- March 31, 2021: Deadline for businesses to e-file Forms 1099 and 1096 to the IRS, except Form 1099-NEC

- April 12, 2021: Deadline for employees who earned more than $20 in tip income in March 2021 to report this income to their employers

- April 15, 2021: Deadline to file individual tax returns (Form 1040) and C Corporation (Form 1120) for the tax year 2020 or to request an automatic extension (Form 4868) for an extra six months to file your return, and for payment of any tax due

- April 15, 2021: Deadline for household employers who paid $2,200 or more in wages in 2020 to file Schedule H for Form 1040

- April 15, 2021: Deadline for first-quarter estimated tax payments for the 2021 tax year

- May 10, 2021: Deadline for employees who earned more than $20 in tip income in April 2021 to report this income to their employers

- June 10, 2021: Deadline for employees who earned more than $20 in tip income in May 2021 to report this income to their employers

- June 15, 2021: Deadline for second-quarter estimated tax payments for the 2021 tax year

- June 15, 2021: Deadline for U.S. citizens living abroad to file individual tax returns or file Form 4868 for an automatic four-month extension

- July 12, 2021: Deadline for employees who earned more than $20 in tip income in June 2021 to report this income to their employers

- Aug. 10, 2021: Deadline for employees who earned more than $20 in tip income in July 2021 to report this income to their employers

- Sept. 10, 2021: Deadline for employees who earned more than $20 in tip income in August 2021 to report this income to their employers

- Sept. 15, 2021: Deadline for third-quarter estimated tax payments for the 2021 tax year

- Sept. 15, 2021: Final deadline to file corporate tax returns for tax year 2020, if an extension was requested (Forms 1120, 1120-A, 1120-S)

- Oct. 12, 2021: Deadline for employees who earned more than $20 in tip income in September 2021 to report this income to their employers

- Oct. 15, 2021: Final extended deadline to file individual tax returns for the year 2020 (Form 1040)

- Oct. 15, 2021: Deadline for taxpayers who earned $69,000 or less in adjusted gross income (AGI) for tax year 2020 to use Free File to prepare and file their returns

- Nov. 10, 2021: Deadline for employees who earned more than $20 in tip income in October 2021 to report this income to their employers

- Dec. 10, 2021: Deadline for employees who earned more than $20 in tip income in November 2021 to report this income to their employers-

TAX CALCULATORS – PROVIDED BY CALCXML

- What is my potential estate tax liability?

- Federal income tax calculator

- Should I adjust my payroll withholdings?

- Will my investment interest be deductible?

- How much self-employment tax will I pay?

- Capital gains (losses) tax estimator

- Compare taxable, tax-deferred, and tax-free investment growth

- How much of my social security benefit may be taxed?

- What are the tax implications of paying interest?

- Should I itemize or take the standard deduction?

- What is my tax-equivalent yield?

- Tax refund estimator

- Tax freedom day

TAX RECORDS RETENTION

Federal law requires you to maintain copies of your tax returns and supporting documents for three years. This is called the “three-year law” and leads many people to believe they are safe provided they retain their documents for this period of time. However, if the IRS believes you have significantly underreported your income (by 25 percent or more), or believes there may be indication of fraud, it may go back six years in an audit. To be safe, use the following guidelines.

Even if the original records are provided only on paper, they can be scanned and converted to a digital format. Once the documents are in electronic form, taxpayers can download them to a backup storage device, such as an external hard drive, or burn them onto a CD or DVD (don’t forget to label it). Create a backup set of records and store them electronically. Keeping a backup set of records — including, for example, bank statements, tax returns, insurance policies, etc. — is easier than ever now that many financial institutions provide statements and documents electronically, and much financial information is available on the Internet. You might also consider online backup, which is the only way to ensure that data is fully protected. With online backup, files are stored in another region of the country, so that if a hurricane or other natural disaster occurs, documents remain safe.

IRS LINKS

Schedule your consultation by calling +1-516-464-7444 or emailing info@cpaclinics.com

MAKE WISE BUSINESS DECISIONS

SAVE MONEY AND TIME

Call Us Now +1-516-464-7444

CPA CLINICS

Decisions With Us

Combined Experience