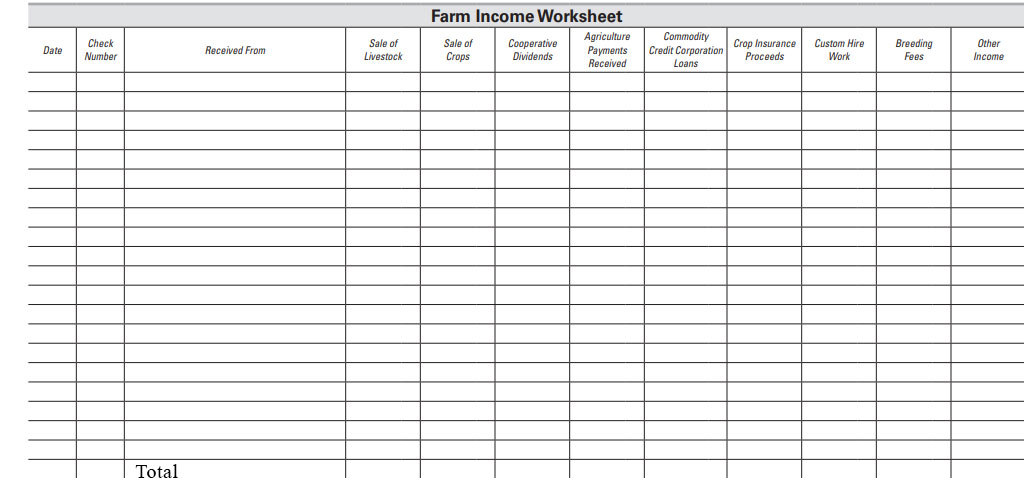

Agricultural Program Payments

Commodity Credit Corporation (CCC)

Loans

Loan proceeds are generally not included in income. But if a farmer pledges a portion of crop production to secure a CCC loan, the proceeds can be treated as if it were a sale of crops. If this method is elected, the amount reported as income is added to the basis of the commodity.

Conservation Reserve Program (CRP)

Under this program, the government pays farmers with highly erodible or other specified cropland to convert its usage to a less intensive use. Rental payments and one-time incentive payments are taxable and are subject to self-employment tax.

Exception: CRP payments made to taxpayers who are receiving Social Security retirement or disability benefits are exempt from self-employment tax.

Crop insurance and Crop Disaster Payments

Insurance proceeds (including government disaster payments) received due to damaged crops are taxable in the year received. This includes payments for the inability to plant crops because of drought, flood, or any other natural disaster. The taxpayer can elect to postpone reporting income until the following year if:

- The cash method of accounting is used,

- Insurance proceeds are received in the same year the crops were damaged, and

- Under normal business practice, the taxpayer would have included income from the damaged crops in any tax year following the year the damage occurred.

Feed Assistance and Payments

The value of benefits received under this program is taxable. The government provides benefits to qualifying livestock producers when a natural disaster causes a livestock emergency. Benefits may be in the form of partial reimbursement of the cost of feed, certain transportation expenses, and donations of, or sale at, below market price of feed owned by the CCC. The following are included in taxable income.

- The market value of donated feed.

- The difference between the market value of feed and the reduced price of feed purchased by the taxpayer.

- Any cost reimbursements received.

These benefits are taxable in the year received. They cannot be postponed under the crop insurance or weather-related sale of livestock rules. A corresponding deduction for the cost of feed, plus the benefit included in income, is allowed.